Latest news about bitcoin, ethereum, blockchain, mining, cryptocurrency prices and more. The latest cryptocurrency news.

WIN 1 BITCOIN IN 3 MONTHS on IFAUCET, 1 BITCOIN = $ 9,213.67

The largest collection of Bitcoin and Altcoin taps. 1 Bitcoin = € 9,213.67

This site is a compilation of the list of free Bitcoin and Altcoin taps (LTC, DOGE, DASH, etc.) with the highest rates so you can earn free BTC and Altcoin.

You can collect many Bitcoins, Dogecoins and Litecoins from different faucet sites from this single site ifaucet

You can collect all day or in your spare time and get more than 200,000 satoshi per day.

There are 3 steps to get the reward (Free Bitcoins):

1. Enter your Bitcoin, litecoin or other cryptomoney address (if you don't have one, you can create it for free)

2. Solve the captcha

3. Click on Claim

You can easily generate your list of favorite sites, add new sites to the system (if not already in the system) and know the features of each Bitcoin tap site.

It is the best way to earn cryptomoney quickly.

Earn accumulated satoshis to convert to bitcoins (BTC):

- register with your bitcoin address, collection of Bitcoin and Altcoin

- surf on these sites and collect bitcoins (or accumulate for deferred payment).

There is also a rotator for each of these electronic money, it can be launched from the beginning which makes things much easier when working on this page.

Usually, beginners collect their first bitcoin after two or three months, or $ 9,213.67. ifaucet

Ethereum faucet list

IOST Launches 2nd Event of Year-Long NFT Event Series with Limited Edition “Genesis” Badge

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Ethereum Will Soon See 2,000 TPS with This Zero-Knowledge Layer-2 Application

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Analyst Sets Bitcoin Target at $10,450 as Price Holds Mid-2019 Support

- As Bitcoin dips below $9,500, a prominent market analyst sees the cryptocurrency resuming its uptrend towards $10,450.

- Michaël van de Poppe, a full-time trader from the Amsterdam stock exchange, predicted the bullish scenario as Bitcoin maintained a concrete price floor above $$9,250-9,300.

- The same support range was instrumental in sending the bitcoin price towards $14,000 in 2019.

Bitcoin could retest its June 1 high if it manages to hold at least above $9,250, according to prominent market analyst Michaël van de Poppe.

The Amsterdam stock market trader said in a Friday tweet that he sees the BTC/USD exchange rate hitting $10,450 in the coming sessions. It is the same level that halted Bitcoin’s uptrend earlier this month – and sent its price to as low as $8,895.

Nevertheless, the cryptocurrency underwent a sharp upside recovery and closed above a short-term support range – defined by $9,250 and $9,300. Mr. Poppe said holding the area could prompt Bitcoin to consolidate sideways before it moves above $9,550.

“Might be consolidating in the range some more,” he tweeted. “Breaker of $9,550 would be the next step.”

Bitcoin price chart on TradingView.com showing it holding support above $9,250-$9,300. Source: TradingView.com, Crypto Michaël

Mr. Poppe further indicated that breaking above $9,550 would lead to an extended breakout trend, first towards circa $10,000, followed by a retest of $10,450.

A Significant Bitcoin Support Area

The range presented by Mr. Poppe also coincided with another critical support defined by Bitcoin’s 50-day moving average (the blue wave in the chart below).

Bitcoin price chart on TradingView.com showing it testing support near its 50-day moving average. Source: TradingView.com

Traders have lately maintained their bullish bias above the 50-DMA. Staying below the blue wave has raised possibilities of Bitcoin testing levels near or above $10,000, a critical resistance level.

The bias has received further strength from a confluence price floor near $9,200. Bears, for instance, attempted to close below the said level June 11 and June 15. Nevertheless, bulls neutralized the downside sentiment with an equally intense buying pressure near the dip.

Each move below $9,200 met with a sharper pullback.

Bitcoin price chart on TradingView.com showing it testing support near $9,200. Source: TradingView.com

Part of the reason why traders show a more robust accumulation behavior near $9,200 is its historical relevance during the 2019 price rally. The level behaved as a concrete price floor during Bitcoin’s uptrend towards $14,000.

Meanwhile, it also capped the price from falling during Bitcoin’s price correction from the same top.

A Dissenting Scenario

A downside scenario is also brewing inside the Bitcoin market with the formation of a Falling Wedge pattern.

As NewsBTC covered earlier, the technical indicator point to the cryptocurrency breaking lower to as far as $8,600 before it breaks out of the range and retests $10,400-$10,500.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Bitcoin SV President Hits Out at Binance as Former Critic Becomes Top Miner

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Last 2 Times This Signal Was Seen, Bitcoin Dove 50%. It’s About to Happen Again

Bitcoin’s recent consolidation has left analysts and investors alike largely puzzled as to what comes next.

Nothing is a better sign of this than the funding rates of BTC futures markets, which are converging towards 0.00%. This shows that both the long and short side of the market is not overvalued.

An analyst has suggested that a retracement to $5,000 is possible as a key macro momentum indicator is poised to flip bearish for the first time since the second half of 2018.

Related Reading: Crypto Tidbits: BTC Fails at $10k, Ethereum Coins Explode, Coinbase Looks to Add 18 Altcoins

Bitcoin Trend Indicator Is About to Trend Bearish

In the middle of 2019, Bitcoin broke past resistance after resistance in rapid succession. The price action was so strong that many expected for BTC to set a new all-time high that year, with some tossing out high price predictions of $50,000 — or more.

Yet there were some analysts forecasting a retracement. One said that Bitcoin would fall to $6,400 — a drop of approximately 50% from the price at the time he made that call.

That same analyst recently suggested that there’s potential for Bitcoin to retrace 50% in the coming months, which would imply a low of ~$5,000 prior to a bounce.

The chart he shared below illustrates this sentiment well. It shows Bitcoin’s macro price action alongside a channel/momentum indicator that has attempted to determine in what macro direction BTC is trending.

Each time the channel flipped red over the past five years, the price of Bitcoin retraced 50% — hence the forecast of a potential retracement to the $5,000s.

Macro s price chart from trader "Dave the Wave" (@Davonwave on Twitter). Chart from TradingView.com.

Importantly, the indicator that the trader shared is lagging. That’s to say, Bitcoin may actually trend higher while the channel is red, That doesn’t take away from the importance of the indicator, though, especially considering its historical precedent.

This Time Is Different

The indicator depicted by the analyst is seemingly poised to roll over. Yet there is a confluence of positive technical and fundamental factors that signal Bitcoin will move higher out of the ongoing consolidation.

Per previous reports from NewsBTC, BTChas traded in nine five-week, 20% consolidations over the past two years. A data analyst found that 77% of those patterns have broken higher, suggesting the ongoing consolidation has a high historical chance of breaking higher.

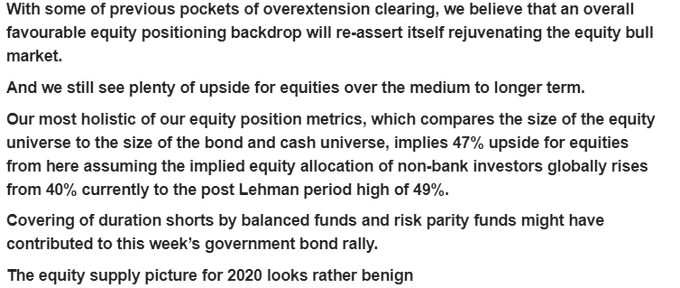

In terms of fundamentals, JPMorgan is currently expecting a 47% rally in the value of equities, despite the S&P 500 already rallying 40% from the March lows.

Bitcoin will benefit if equities rally further due to the relatively tight correlation between cryptocurrencies and traditional financial markets that has formed over recent months.

Related Reading: BTC Hash Rate Recovers to Pre-Halving Levels, But a Chinese Mine Just Burned Down

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Technical charts from Tradingview.com Last 2 Times This Signal Was Seen, Bitcoin Dove 50%. It's About to Happen Again

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Chainalysis Study Finds Roughly 3.5 Million Bitcoin Moves Frequently Between Exchanges for Trading

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

ParaFi Invests in Kyber Network as Buzz Grows Around DeFi Projects

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Ethereum Eyeing Last Line of Defense: Here Are Key Supports To Watch

Ethereum is declining steadily below the $235 resistance zone against the US Dollar. It seems like ETH could decline heavily if it breaks the $225 support zone in the near term.

- Ethereum is trading in a bearish zone below $232 and the 100 hourly simple moving average.

- The price is slowly declining towards the key $225 support zone.

- Yesterday’s followed major declining channel is still active with resistance near $232 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could decline sharply if it fails to stay above the main $225 support zone.

Ethereum Price Declining Steadily

In the past two days, Ethereum price followed a bearish path from the $238-$240 resistance against the US Dollar. ETH broke many supports such as $235 and $232 to move into a short-term bearish zone.

It even settled below the $232 level and the 100 hourly simple moving average. Ether traded close to the $225 support zone and formed a new intraday low at $226. It is currently correcting higher and trading above $228.

An initial resistance on the upside is near the $230 level. It is close to the 50% Fib retracement level of the recent decline from the $235 swing high to $226 low. More importantly, yesterday’s followed major declining channel is still active with resistance near $232 on the hourly chart of ETH/USD.

Ethereum price trades below $230. Source: TradingView.com

The channel resistance is near the 61.8% Fib retracement level of the recent decline from the $235 swing high to $226 low. Therefore, the price is likely to face a strong selling interest near the $232 level and the 100 hourly simple moving average.

On the downside, the main support is seen near the $225 level. If the price fails to stay above the $225 support, there is a risk of a larger decline towards the $218 and $215 levels in the near term.

Chances of an Upside Break in ETH?

To move into a positive zone, Ethereum must break the channel resistance, $232, and the 100 hourly SMA. The next key resistance is near the $238 and $240 levels.

If ether price settles above the $240 resistance zone, it could start a strong increase. The next set of resistances might be near the $250 and $255 levels.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is about to move into the bullish zone.

Hourly RSI – The RSI for ETH/USD is now just above the 40 level, with bearish signs.

Major Support Level – $225

Major Resistance Level – $232

Take advantage of the trading opportunities with Plus500

Risk disclaimer: 76.4% of retail CFD accounts lose money.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Nomura-Backed Crypto Custody Venture Launches After 2 Years in the Works

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Latest CCID Blockchain Rankings Place IOST 1st in Basic Tech, 4th Overall

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Ripple (XRP) Signaling More Downsides Unless It Surpasses $0.19

Ripple is slowly moving lower and now trading well below $0.1920 against the US Dollar. XRP price remains at a risk of more losses unless it gains strength for a push above $0.1900.

- Ripple is facing an increase in selling pressure below the $0.1920 resistance against the US dollar.

- The price is currently trading below the $0.1900 support and the 100 hourly simple moving average.

- There is a declining channel forming with resistance near $0.1890 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair could continue to move down towards the $0.1850 and $0.1820 support levels.

Ripple Price Could Extend its Decline

Ripple price started a fresh decrease after it failed to test the $0.2000 resistance. XRP traded as high as $0.1986 and recently declined below the $0.1950 support zone.

The bears gained traction and pushed the price below the $0.1900 support and the 100 hourly simple moving average. During the decline, there was a break below a major bullish trend line with support at $0.1910 on the hourly chart of the XRP/USD pair.

It traded as low as $0.1868 and it seems like there are chances of more losses. An initial resistance is near the $0.1890 level or the 23.6% Fib retracement level of the recent slide from the $0.1986 high to $0.1868 low.

Ripple price below $0.1900. Source: TradingView.com

There is also a declining channel forming with resistance near $0.1890 on the same chart. The first key resistance is near the $0.1900 zone and the 100 hourly simple moving average. The next major resistance is near the $0.1925 level or the 50% Fib retracement level of the recent slide from the $0.1986 high to $0.1868 low.

Clearly, ripple is facing a lot of hurdles on the upside near $0.1900 and $0.1925. A successful close above $0.1900 and then a follow up break above the $0.1925 level is needed for a strong upward move.

More Losses in XRP?

If ripple fails to recover above $0.1900 and the 100 hourly SMA, there are chances of more downsides. An initial support on the downside is near the $0.1850 level.

The main support is near the $0.1820 level, below which the bears are likely to aim a downside break below the $0.1800 support in the coming days.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is moving nicely in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now correcting higher from the 30 level.

Major Support Levels – $0.1850, $0.1820 and $0.1800.

Major Resistance Levels – $0.1900, $0.1925 and $0.1950.

Take advantage of the trading opportunities with Plus500

Risk disclaimer: 76.4% of retail CFD accounts lose money.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Bitcoin Could Narrowly Avoid a Downside Thrust if it Closes Above 100 SMA

Bitcoin is declining steadily and trading below $9,400 against the US Dollar. BTC could decline sharply below $9,250 if it fails to reclaim the 100 hourly simple moving average.

- Bitcoin is slowly moving lower and now trading well below the $9,500 pivot level.

- The price is showing a few bearish signs below $9,400 and the 100 hourly simple moving average.

- There is a crucial declining channel or a bullish flag pattern forming with resistance near $9,400 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could decline sharply below $9,250 if there is no close above the channel resistance.

Bitcoin Price Sliding Towards $9,250

After forming a short-term top near the $9,500 level, bitcoin price started a fresh decline against the US Dollar. BTC broke the key $9,500 support and pivot zone to start a downside correction.

It broke the 23.6% Fib retracement level of the upward move from the $8,907 low to $9,600 swing high. The bears were able to push the price below the $9,400 level and the 100 hourly simple moving average.

It seems like there is a crucial declining channel or a bullish flag pattern forming with resistance near $9,400 on the hourly chart of the BTC/USD pair. On the downside, the first key support is seen near the $9,250 level. It is close to the 50% Fib retracement level of the upward move from the $8,907 low to $9,600 swing high.

Bitcoin price chart: Source: TradingView.com

Bitcoin is clearly struggling to clear the channel resistance and the 100 hourly SMA to resume its upside above $9,500. Therefore, there is a risk of more losses below the $9,250 support level.

The next major support is near the $9,140 level, below which the price will most likely continue lower towards the $9,000 support level in the near term.

Upside Break in BTC?

If bitcoin manages to clear the channel resistance at $9,400 and the 100 hourly SMA, the bulls are likely to gain strength. The first key resistance is near the $9,500 level, above which the price could revisit the $9,600 swing high.

Any further gains could open the doors for a larger upward move towards the main $10,000 resistance (as discussed using the daily chart).

Technical indicators:

Hourly MACD – The MACD is slowly gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now well below the 50 level, with a bearish angle.

Major Support Levels – $9,250 followed by $9,080.

Major Resistance Levels – $9,400, $9,500 and $9,800.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Gaming Giant Ubisoft Is Bringing Ethereum to Benefit the UNICEF Using “Rabbids”

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

This Pattern Could Trigger Explosive Bitcoin Volatility; Crucial Levels to Watch For

Bitcoin investors have been growing impatient as the benchmark cryptocurrency continues hovering within the mid-$9,000 region. It has been consolidating here for many weeks, and each attempt to catalyze momentum – in either direction – has been futile.

BTC has seen trends like this in years past, and they nearly always resolve in the crypto making a massive movement that defines its trend over a long-term period.

As such, analysts do believe that the same possibility is in play here. One trader is even offering a chart showing that this sideways trading could come to a harsh end in the coming few days.

Assuming that this is the case, there are a few critical levels to watch, as which of these is broken first could offer insight into how it will trend in the weeks and months ahead.

Bitcoin’s Consolidation Phase Persists, But May Soon Come to a Violent End

At the time of writing, Bitcoin is trading down marginally at its current price of $9,400 – the level at which it has been trading at for the past few days.

BTC’s multi-week consolidation phase first began in early-May, after the cryptocurrency ran to highs of over $10,000 before facing a harsh rejection.

From this point, it began trading sideways and establishing a range between the upper $8,000 region and the lower-$10,000 region.

This same trading range still exists today, and the crypto has not been able to break firmly above or below either of these levels.

Bitcoin will remain without a trend until one of these levels is firmly broken.

There is a triangle pattern the crypto is currently caught within that seems to suggest that BTC will soon see a massive uptick in volatility.

This potentially imminent movement could offer a resolution to this trading range.

The chart seen below – offered by a popular crypto analyst – shows that Bitcoin is slated to reach the apex of the triangle in the next few days.

Image Courtesy of Kaleo. Chart via TradingView

Here are the Critical Levels That Will Determine BTC’s Fate

There are a few levels that could determine the fate of Bitcoin in the months ahead.

Josh Rager – a respected analyst and trader – spoke about some of the key near-term levels he is watching, noting that $9,250 and $9,550 are the two key levels that could spark some volatility.

“BTC: Lower time frames show compression of the price which should lead to volatility in the next 12 hours. Reclaiming $9550 is still the level to watch for a continuation to the upside. Break back down would lead to $9250 and likely lower. This is current range to watch,” he explained.

Image courtesy of Josh Rager. Chart via TradingView

Once one of these levels break, whether bears shatter its $8,500 support or bulls surmount its $10,500 resistance will set the tone for where it trends throughout the rest of 2020.

Featured image from Shutterstock. Charts from TradingView.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

JPMorgan Suggests a 50% S&P 500 Rally Is Near, Boosting Bitcoin Bull Case

It’s been an explosive past few months for Bitcoin, equities, and other global markets.

After a liquidation event in March that sent cryptocurrencies down by over 50% and other asset classes down almost as much, a bounce has ensued that has largely deleted the losses of March.

BTC now trades for $9,400, up by approximately 30% since the start of the year. And the stocks of the FAANG are up on the year, surging as the world adopts digital technologies in response to the pandemic.

Some have deemed this a relief rally triggered by central bank money printing, but JPMorgan analysts recently came to the conclusion that the S&P 500 could rally even higher. And Bitcoin stands to benefit.

Related Reading: There’s a 77% Chance Bitcoin Rallies Out of Its Range: Historical Analysis

JPMorgan Predicts S&P 500 Could Rally Even Higher — And Bitcoin Can Too

According to a research note shared by Dan Tapiero — CEO of a precious metal investment company and a prominent Bitcoin bull — JPMorgan is predicting equities will rally 47% from here. This comes after they rebounded approximately 40% from the March lows.

The analysts attributed their prediction to their “equity position metrics,” which tries to draw valuations of equities by looking at the size of the bond and cash “universe.”

The insinuation is that with the amount of cash in the system exploding higher due to central banks and bonds rallying due to central-bank buying, equities may be relatively undersized:

“With some of previous pockets of overextension clearing, we believe than an overall favorable equity positions backdrop will re-assert itself rejuvenating the equity bull market.”

Tapiero suggested that this may be bullish for Bitcoin and gold, writing that some “excess cash” in the reserves of investors may “go into gold and Bitcoin” instead of equities.

He’s not wrong in suggesting so.

A team of JPMorgan analysts reported on June 11th that for the past few months, “Cryptocurrencies have traded more like risky assets like equities—a significant change relative to the prior couple of years.”

So should stocks continue to rip higher, so too should Bitcoin.

Stocks Are Reaching “Bubble” Territory, Others Argue

Not everyone is convinced that stocks (and thus Bitcoin) are ready to continue higher though, especially as the underlying economy remains somewhat weak due to lockdowns.

Jeremy Grantham, a prominent stock trader that called three previous stock market tops, told CNBC’s “Closing Bell” this week that he sees tell-tale signs of a stock bubble.

"This is really the real McCoy," says legendary investor Jeremy Grantham on whether the recent rally is a sign of a bubble to come. "This is crazy stuff." pic.twitter.com/XetUBqqPBk

— CNBC's Closing Bell (@CNBCClosingBell) June 17, 2020

Scott Minerd, the Global CIO of Guggenheim Partners, made a very similar comment just a week earlier. He also said that he sees bubble-like qualities in the equity markets.

Should stocks crash, so too should Bitcoin — just like in March.

Related Reading: These “Dire” On-Chain Metrics Show Bitcoin Is on the Verge of Dropping to $7k

Featured Image from Shutterstock Price tags xbtusd, btcusd, btcusdt Charts from TradingView.com JPMorgan Suggests a 50% S&P 500 Rally Is Near, Boosting Bitcoin Bull Case

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Ethereum Will Be “Unstoppable” Once it Breaks Above This Crucial Level

Ethereum has been flashing some signs of tempered weakness throughout the past several days and weeks, hovering just above the lower boundary of its long-held consolidation channel.

The cryptocurrency’s present weakness is primarily rooted in that of Bitcoin, which has seen faltering momentum as it continues struggling to break above the key psychological resistance existing at the five-figure price region.

It does appear that this weakness could cause it to face a harsh rejection that causes it to spiral lower, but until it firmly breaks beneath the lower boundary of its trading range at $9,000, this possibility remains speculative.

That being said, if buyers are able to give the market a much-needed boost, it is a strong possibility that Ethereum and other altcoins could see some major momentum.

One analyst recently explained that ETH will be “unstoppable” once it is able to firmly surmount one critical resistance region.

He does believe that this level will be broken above at some point this year due to several fundamental factors.

Ethereum Flashes Signs of Near-Term Weakness, But Macro Outlook Remains Strong

At the time of writing, Ethereum is trading down just under 1% at its current price of $231.

The cryptocurrency has been hovering within the $230 region for the past few days, but a slight increase in selling pressure appears to have put it at risk of breaking below this level.

A firm decline beneath this price would be dire, as it happens to mark the lower boundary of its multi-month trading range between $230 and $250.

If its buyers continue guarding this key support, they could provide Ethereum with a boost that sends it back up to the upper boundary of its trading range.

In order for it to enter a firm macro bull market, however, it will need to do more than simply shatter the top of its range at $250.

One analyst recently explained that the critical level to watch for sits between $350 and $400. He believes a break above this will make the crypto “unstoppable.”

“Above Gray box ETH becomes unstoppable… And I believe this year it will be assaulted with great ferocity and overcome as 2.0, DeFi, and staking take this to new heights,” he explained.

Image courtesy of Pentoshi. Chart via TradingView

Fundamental Strength Could Help Propel It Past This Key Level

In order for Ethereum to surmount this crucial price region, it will likely require a combination of technical and fundamental strength.

It does appear to be strong on the fundamental front, as its on-chain demand has skyrocketed in recent times.

Another respected analyst recently spoke about why he believes ETH has yet to see peak on-chain demand, pointing to the rise of DeFi as well as the heightened scalability that ETH 2.0 will offer.

He concludes that the transition to 2.0 coupled with continued growth in the DeFi sector will lead to heightened capital inflows.

“Likely the combination of both ETH 2.0 and Defi’s continued growth will lead to a higher capital flow in a 3 month period over the next 2 years compared to 2017.”

Featured image from Shutterstock. Charts from TradingView.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Bitcoin Remains Highly Bullish Because of These 2 Simple Factors

Bitcoin has once again extended its long-held bout of sideways trading. The cryptocurrency has struggled to garner any notable momentum as it continues trading within the mid-$9,000 region.

Its ability to capture a strong foothold within this price region after facing some signs of weakness earlier this week does appear to be a positive sign.

That being said, there are a few factors that point to underlying weakness, including its three rejection at $10,500 over the past six months, its countless rejections at $10,000, and the fact that it has been setting lower highs throughout the course of its consolidation phase.

In spite of these overtly bearish factors, analysts still remain confident that the cryptocurrency could be well-positioned to see some notable upside in the mid-term.

This upside could be provided by two primary factors: BTC’s ability to maintain its position above its 100 and 200-day moving averages, and its robust trading volume.

In order for these factors to spark a sharp uptrend, there’s a key level buyers must hold the crypto above in the days and weeks ahead.

Bitcoin Still Strong Despite Showing Signs of Weakness

At the time of writing, Bitcoin is trading down marginally at its current price of $9,400. This is around the level at which it has been trading at throughout the past several days and weeks.

Earlier this week it did attempt to retest the resistance laced in the upper-$9,000 region but was stopped short by a rejection at $9,600.

This is just one of the many overt signs of weakness that the benchmark digital asset has flashed in recent times, but it is important to note that it still remains fundamentally strong for a couple simple reasons.

One analyst recently pointed to two factors for why his outlook on BTC in the mid-term remains bright.

These factors include its ability to remain above both its 100 and 200-day moving averages, as well as it forming a strong volume profile despite its lackluster price action as of late.

“Bitcoin: Just a picture sharing the significance of the 100-Day and 200-Day MA. And we’re acting above that, so no reason to be extremely bearish (in my opinion). Volume also nice,” he explained.

Image Courtesy of Crypto Michael. Chart via TradingView

Here’s the Key Level Bulls Must Defend to Catalyze Further Upside

In order for Bitcoin to push higher in the near-term and confirm this underlying strength, there’s a key price region that must be defended.

The same analyst explained that the price region between $9,200 and $9,250 is a key support area, and an ardent defense of this could allow for an upwards trend continuation.

“Bitcoin: Crucial level held and we are back in a narrow range. As long as $9,200-9,250 holds, I suspect continuation. Next job; breaking and flipping $9,550-9,600. If we do, the grind towards the highs can start. Acceleration above $10,250-10,500 towards $11,500.”

Image Courtesy of Crypto Michael. Chart via TradingView

How it responds to this key support should provide significant insight into where it trends next.

Featured image from Shutterstock. Charts from TradingView.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Chris Giancarlo: XRP Not a Security But An Alternative Currency

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Market Wrap: Bitcoin Quiet at $9.3K While DeFi Gets Loud

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

FTX Releases COMP Derivatives to Keep Up With DeFi Frenzy

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Reddit Seeks Scaling Solution for Ethereum-Based ‘Community Points’

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

First Mover: As US Stocks Defy Economic Gravity, Bitcoiners Shudder at March Memory

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Polkadot Is Latest Blockchain to Explore Redeemable Bitcoin Tokens

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Bitcoin Still Undervalued After Q2 Rally, Price Metric Shows

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Bitcoin Accurately Mirroring Fractal That Sent Its Price to $14K in 2019

- Bitcoin is consolidating sideways in a $1,500-wide trading range since the beginning of May 2020.

- While observers anticipate the cryptocurrency to head lower, a fractal from 2019 shows a different picture.

- So it seems, bitcoin is currently mirroring the same trend pattern that sent its price to $14,000 last year.

After rallying by more than 150 percent from its March 2020 lows, Bitcoin’s upside bias has paused inside a strict trading range.

The benchmark cryptocurrency has repeatedly tested $10,000-10,500 zone as its short-term resistance. Meanwhile, it has located moderately strong support above $8,600. Since May 2, 2020, bitcoin is consolidating sideways in the range defined by the said two levels.

The bitcoin chart is showing an interim bias conflict, with traders unable to define a trend above $10,000 or below $8,600. Nevertheless, a poll conducted by prominent analyst Josh Rager shows that about 55 percent of traders see Bitcoin moving downwards from its current position.

But cryptocurrency analysis portal TradingShot sees a different scenario ahead. The famous TradingView-based bitcoin analyst said the BTC/USD could head higher – above $10,500 – based on a historical pattern from mid-2019.

The Bullish Bitcoin Fractal

TradingShot showed Bitcoin mirroring moves of a 2019 fractal – the same that sent its price up towards $14,000.

The fractal consists of a sequence of Bitcoin’s consolidation and rallies. For instance, ‘Sequence 1’ in the chart below shows the cryptocurrency trending sideways between March 2019 and April 2019. The consolidation ends as the price breaks out to the upside – from circa $5,000 to near $9,000.

Meanwhile, the Relative Strength Indicator (RSI) also surges from 52 to 89, reflecting that the upside move is strong.

After rising, Bitcoin enters another consolidation phase, with its RSI declining. It stays in the range for less than a month before continuing its move towards $14,000. The RSI jumps in sync.

In Sequence 2, one can notice Bitcoin practically repeating the exact price trend from 2019. A jump followed by a small period of consolidation that leads to another sideways action. Meanwhile, the RSI is also mirroring the old pattern.

“What followed in June 2019 after the last consolidation was one last rise to the (blow-off) top of June 26, 2019,” explained TradingShot. “So it will not be far-fetched if we get another rise now after the current consolidation is over.”

Red Alerts

Meanwhile, the analyst reminded that the current consolidation pattern is taking longer than the one from May 15-June 11, 2019. He further noted that the $14,000-top blew off that caused the price to fall to as low as $3,858.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

High Leverage and Tight Spreads Make CryptoAltum a Worthy Contender in Crowded Crypto CFD Space

The new Marshall Island-based crypto derivatives trading platform is making a wave in the trading community by offering attractive trading opportunities. Less than a year old, the CryptoAltum platform is a feature-rich CFD trading platform with a range of trading instruments including Cryptocurrencies, Forex, Equity Indices and Gold.

CryptoAltum is an easy to use platform that is designed keeping the users’ convenience in mind. It is designed to accommodate both novice and experienced traders, with different trading tiers in place based on their trading activity on the platform. It should not take more than a few minutes to register and start trading on CryptoAltum. All one has to provide is their name, email address, and country of residence to open an account.

Trading on CryptoAltum

With the account open, users can fund their account with BTC, BCH, XRP, ETH, LTC or USDT and start trading any of the available instruments, 24/7. All trades are executed using a Straight Through Processing (STP) model at the best available market price. The CryptoAltum platform provides users with the highest leverage of 500X at low spreads, which makes it an attractive option for those who intend to make huge profits. Its leverage offering is the highest in crypto markets, which when combined with an average spread of as less as $3 (for the highly volatile BTC), makes it quite tight when it comes to cryptocurrencies. Meanwhile, the platform has some of the top global exchanges as liquidity providers, which allows CryptoAltum traders to enjoy the best prices.

Along with high leverage and tight spreads, CryptoAltum offers the best-in-class trading experience with the industry-leading trading solution. The crypto CFD trading platform is available on almost all devices, thanks to its integration with MetaTrader 5. Users can either use the WebTrader or download MetaTrader 5 (MT5) application on their computers or mobile phones to start trading. The highly customizable MT5 suite offers a range of charts and trading tools to the traders, helping them in the decision-making process for profitable trades.

Users on CryptoAltum can create multiple accounts, one each for all the base currencies except BTC and XRP, for which 2 accounts are allowed. There is also a free demo account feature available, where users can practice trading without risking their deposit.

Combine the features and trading infrastructure with zero commissions, a huge 100% first deposit and a 50% second deposit bonus, CryptoAltum emerges as the perfect recipe for profitable crypto CFD trading.

Security and Support

CryptoAltum assures the safety of funds and private information stored on the platform by implementing strict cybersecurity measures. The amount of private information collected and stored by the platform is minimal as it does not insist on any identifying information apart from a valid email address. Similarly, majority of crypto funds handled by the platform are secured in multi-signature cold storage facilities in four different locations. It also implements advanced protection against viruses, malware, and keylogging software to preserve the platform’s integrity. At any point, if there is any doubt about the ability of the platform, or have issues with accounts or trades, the CryptoAltum customer support team is always within reach. They can be reached 24/7 over email, live chat, WhatsApp, Telegram or Facebook Messenger at any time.

Overall, CryptoAltum has proven itself to be a platform that can deliver the best crypto trading experience within months of entering the market.

Learn more about CryptoAltum – https://cryptoaltum.com/

Join CryptoAltum at – https://portal.cryptoaltum.com/register

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Bitcoin Miner Maker Ebang Estimates $2.5M Loss for Q1 in IPO Prospectus Update

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

There’s a 77% Chance Bitcoin Rallies Out of Its Range: Historical Analysis

The biggest question on the minds of Bitcoin investors is if the range the cryptocurrency has been stuck in will break to the upside or downside.

For almost two months now, the leading cryptocurrency has traded within a tight $1,000-2,000 range below the crucial $10,500 resistance. The chart below illustrates this well: it shows that every attempt at breaking above or below the range is rejected, resulting in BTC converging on one price region.

The price action has been so “boring” that analysts have observed that volatility indicators are tightening to levels not seen since the March crash.

The market seems rather indecisive: there are both ardent bulls and bears on social media platforms while the funding rates of futures markets attempt to converge around 0.00%.

But according to a data analyst, there’s a high chance Bitcoin breaks higher due to historical precedent.

Related Reading: Buying Bitcoin at $8k or $9k Won’t Matter in 2 Years: Fund Manager Explains

Bitcoin Has a High Chance of Breaking Higher, History Suggests

Although the price action over the past six-seven weeks has been deemed boring by most traders, it’s not uncommon for Bitcoin to consolidate as it has.

A data analyst shared the chart below on June 17th, indicating that “In the past two years, this is the 10th occurrence of $btcusd being stuck in a sub 20% range for longer than 5 weeks.”

This is relevant because a majority of these consolidation patterns have resolved upwards. “7 out of the previous 9 consolidations have led to a pump,” the analyst wrote.

That’s to say, over the past two years, 77% of the time Bitcoin looked as it does now, prices “pumped.”

The last consolidation this long, for instance, was in November to December of 2019. It preceded a pump from the $7,000 range to $10,500 in the span of two months.

That’s not to say that the current range will resolve higher, but bulls are seemingly in control with the BitMEX futures premium remaining relatively neutral as Bitcoin holds crucial supports.

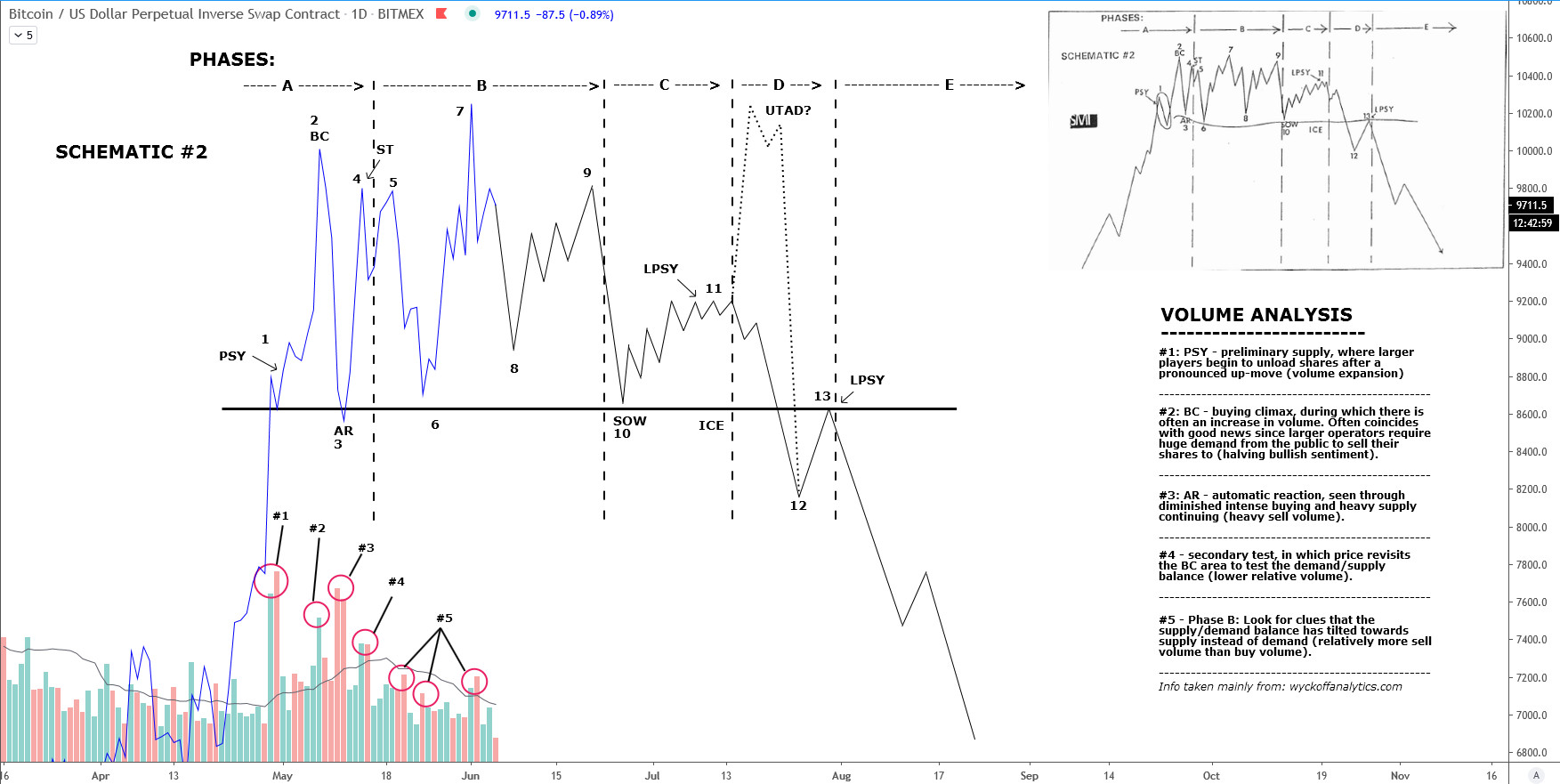

It’s Potentially a Wyckoff Top

Factoring in market volume, though, some have argued that the recent price action is following a textbook top pattern.

As reported by NewsBTC previously, analyst Adam Li noted that Bitcoin’s recent consolidation matches up almost identically with the Wyckoff Distribution schematic by late technical analyst Richard Wyckoff.

The core of the argument is centered around volume, which has been decreasing since the first ~$10,000 peak at the start of May.

There's a 77% Chance Bitcoin Surges Higher Out of Its 20% Range: Historical Analysis Price tags: xbtusd, btcusd, btcusdt Featured Iamge from Shutterstock

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

OKCoin, BitMEX Sponsor Bitcoin Core Developer Amiti Uttarwar

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Bitfinex Granted 2 of 3 Subpoenas in Hunt for Missing Millions

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List

Ethereum Might Not Go Down Quietly: Risk of Bullish Break Grows Above $240

Ethereum is stable above the $230 and $225 support levels against the US Dollar. ETH price seems to be eyeing a major bullish break above $238 and $240.

- Ethereum is currently attempting an upside break above $234 and the 100 hourly simple moving average.

- The price is likely to remain well bid above the $230 and $225 support levels.

- There is a key bullish flag pattern forming with resistance near $234 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a steady rise if it clears the $238 and $240 resistance levels.

Ethereum Price Holding Key Supports

After a failed attempt to clear the $238 resistance, Ethereum price extended its decline against the US Dollar. ETH broke the $232 and $230 support levels, and settled below the 100 hourly simple moving average.

There was a break below the 23.6% Fib retracement level of the upward move from the $218 low to $237 high. However, the decline was protected by the $228 support zone.

A low was formed near $228 and it seems like the 50% Fib retracement level of the upward move from the $218 low to $237 high acted as a strong support. Ether price is currently rising and trading above $230.

It is currently attempting an upside break above $234 and the 100 hourly simple moving average. There is also a key bullish flag pattern forming with resistance near $234 on the hourly chart of ETH/USD. An upside break above the channel resistance at $234 and a close above the 100 hourly simple moving average could open the doors for a test of $238 or $240.

To continue higher, the price must settle above the $240 resistance. In this scenario, the price could continue higher towards the $250 and $255 levels.

Fresh Bearish Wave in ETH?

If Ethereum continues to struggle near the $238 resistance or $240, it could decline again. An initial support is near the $230 level. The main support is now near the $225 level.

A clear break below the $225 support may perhaps decrease the chances of a bullish break above $240 in the coming sessions. The next support is at $218, followed by $215.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly moving in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now just above the 50 level, with a bullish angle.

Major Support Level – $230

Major Resistance Level – $238

Take advantage of the trading opportunities with Plus500

Risk disclaimer: 76.4% of retail CFD accounts lose money.

Win 1 Free Bitcoin - Best Free Bitcoin and Allcoin List