Susquehanna International Group, LLP (SIG), a global trading, technology, and investment firm, disclosed that it holds over $1.8 billion in Bitcoin exchange-traded funds (ETFs) through a 13F-HR filing submitted to the Securities and Exchange Commission (SEC), providing a detailed breakdown of SIG's investment portfolio.

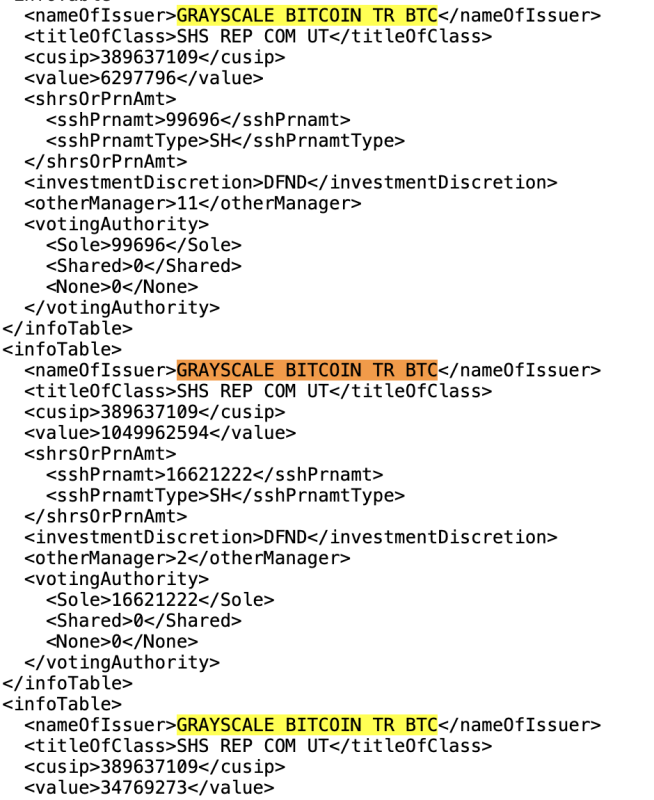

The filing reveals the investment firms biggest positions were in Grayscales Bitcoin ETF GBTC, totaling $1,091,029,663.

The documents also revealed that SIG holds positions in ARK 21SHARES BITCOIN ETF, BITWISE BITCOIN ETF TR, BITWISE FUNDS TRUST (BITCOIN AND ETHER), FIDELITY WISE ORIGIN BITCOIN, FRANKLIN TEMPLETON DIGITAL BITCOIN ETF, GLOBAL X BITCOIN TREND, INVESCO GALAXY BITCOIN ETF, ISHARES BITCOIN TR, PROSHARES TR SHORT BITCOIN, PROSHARES TR BITCOIN STRATE, PROSHARES TR BITCOIN & ETHER, VALKYRIE BITCOIN FD, VALKYRIE ETF TRUST II BITCOIN AND ETHE, VALKYRIE ETF TRUST II BITCOIN MINERS, VALKYRIE ETF TRUST II BITCOIN FUTR LEV, VANECK BITCOIN TR, VOLATILITY SHS TR 2X BITCOIN STRAT, and WISDOMTREE BITCOIN FD.

The total combined amount of assets across all these ETFs add up to over $1.8 billion at the time of writing.

Interestingly enough, the investment firm noticeably holds $4,037,637 worth of ProShares short bitcoin ETF, which aims to offers investors the potential to profit on days when BTC drops in price. In addition to this, SIG also holds $1,004,552 worth of Valkyrie Bitcoin Futures Leveraged Strategy ETF and $97,856,513 worth of Volatility Shares 2x Bitcoin ETF, to profit even further on days when the price of BTC is rising.

Bitcoin ETFs offer institutions a regulated and accessible way to gain exposure to Bitcoin's price movements, but gives up the ability for investors to directly hold the bitcoin themselves.

SIG's disclosure of holding over $1.8 billion in Bitcoin ETFs reflects the growing trend of institutional adoption and investment in Bitcoin as part of a diversified investment strategy. Market researchers and analysts expect more institutions to file these 13F-HR documents with the SEC in the coming months, revealing specifically who has been purchasing spot Bitcoin ETFs since they went live earlier this year in January.

No comments:

Post a Comment