Africa stands at the cusp of a financial revolution as Ecowas region financial ministers and central bank governors advanced plans to launch the single currency initiative, known as the ECO. The Economic Community of West African States (ECOWAS) promises to reshape the economic landscape of 15 nations with the introduction of ECO. Amidst the buzz of this unified currency, a digital contender—Bitcoin—emerges from the shadows, offering unprecedented solutions to the continent's remittance woes. Could Bitcoin hold the key to a more inclusive, cost-effective, and resilient financial future for Africa? Not even a question over here, but an experience. As the ECO currency initiative progresses, Bitcoin emerges as a compelling alternative, offering unique solutions to longstanding financial challenges in Africa.

Exploring some factual narratives, In a statement by Mr Wale Edun ( Nigeria’s Finance minister ) and his colleagues in the region, “The vision for the ECO extends beyond a mere currency. It aspires to become a cornerstone of economic integration, streamlining trade and bolstering monetary stability across the region.” One must be curious about the implementation plans towards actualizing this vision. Pathetically, one of the primary hurdles for the ECO currency is regulatory complexity. Harmonizing monetary policies and regulations across 15 diverse countries is a monumental task. Each member country has its own economic conditions, fiscal policies, and political landscapes, which could complicate the implementation and governance of a unified currency. Regulatory discrepancies may lead to uneven adoption and effectiveness of the ECO currency, potentially undermining its goal of regional economic integration.

Interestingly, the success of the ECO currency will depend heavily on the existing technological infrastructure in member countries. Many regions within ECOWAS still lack reliable internet connectivity and advanced financial technologies. These infrastructural gaps, if not addressed, stand to hinder the effective implementation and operation of the ECO currency, limiting its accessibility and usability for the general population. Bitcoin has already passed these stages in the region with its proven technological efficiency on its core operating layer, and its dynamics even in the face of redundant or no internet connectivity, through Bitcoin based solutions in the region in comparison to ECO, create an added advantage coupled with a glaring display of resilience and efficiency.

ECOWAS countries exhibit significant economic disparities, from resource-rich nations like Nigeria to smaller, less economically developed countries like Guinea-Bissau. A one-size-fits-all monetary policy may not address the unique economic challenges faced by each member country. Disparities like this could lead to imbalances and tensions within the union, potentially destabilizing the ECO currency and the regional economy. Bitcoin however has an advantage in terms of breaking regional bias while offering global acceptance and open trade options.

ECO intends to enhance financial inclusion by providing access to financial services for the unbanked population. But ECO being a proposed regional currency dependent on traditional finance systems interoperably in the ECOWAS controlled countries, implies ECO will subconsciously inherit indigenous problems such as having a substantial portion of the population unbanked due to limited access to traditional banking services. Won’t this leave this currency at the mercy of a democratized digital alternative ? That’s definitely a question: “utility and efficiency” will do justice to overtime as things keep unfolding. Bitcoin provides an alternative means of accessing financial services without the need for a bank account. By offering a decentralized and accessible financial system, Bitcoin empowers individuals and small businesses, fostering economic growth and seamless financial operations.

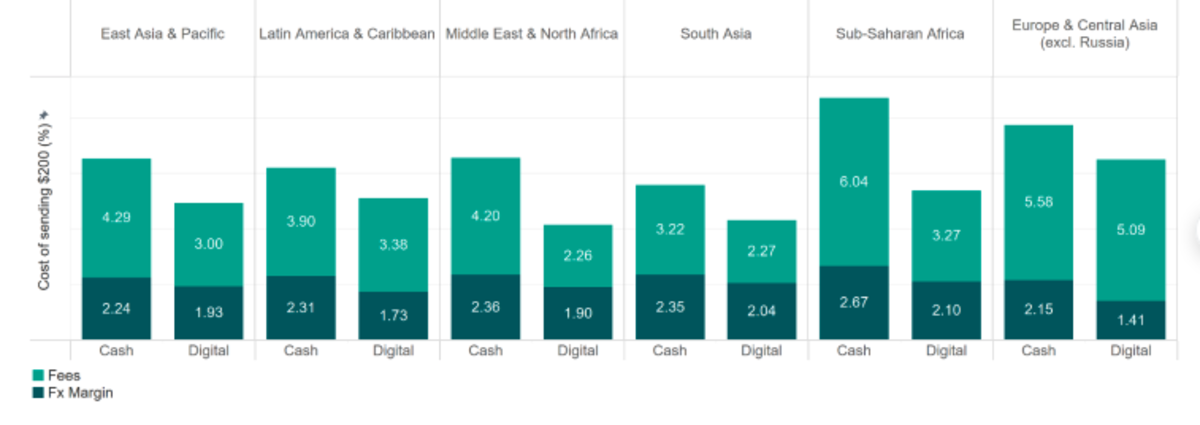

Looking further by comparing the “costs for remittance services among different regions, by breaking down the cost into two components: fee and foreign exchange (FX) margin. Within each region, as displayed below, it differentiates between digital and non-digital remittances. It shows fees account for a large portion of the costs for remittance services. Moreover, costs for non-digital services are consistently higher than those for digital services regardless of the region where the money is being sent to.”

As the only decentralized digital currency, Bitcoin offers a revolutionary solution to the high costs associated with traditional remittance services. Migrant workers sending money home to their families often incur significant fees as shown above, eroding the value of their hard-earned money. Bitcoin transactions, however, are drastically reducing these costs by eliminating intermediaries and offering direct peer-to-peer transfers. This cost efficiency is particularly beneficial in Africa, where remittance flows are a critical source of income for many families.

Facilitating seamless cross-border transactions with Bitcoin is a crucial advantage in the ECOWAS region, where intra-regional trade is encouraged. Unlike the ECO currency, which will still require some level of governmental oversight and regulation, Bitcoin operates independently of national borders. This independence allows for fluid and efficient transactions between businesses and individuals across different countries, promoting regional trade and economic integration. The continuous adoption of Bitcoin will drive growth economically by attracting investments into the fintech and remittance sector while creating new job opportunities and payment rails. The innovative edge of Bitcoin and blockchain technology will spur continuous technological advancements and economic diversification. By embracing these technologies, African countries will progressively position themselves at the forefront of the global digital economy, fostering a culture of innovation and entrepreneurship.

Blockchain technology and the cryptographic algorithms which underpins Bitcoin offers a level of transparency and security that can enhance trust in financial transactions. The immutable nature of blockchain records ensures that transactions are secure and verifiable, reducing the risk of fraud and corruption. This transparency is critical for remittance services, ensuring that funds are transferred securely and efficiently. Additionally, responding to the remittance question on the Mara livedesk in Nashville, Femi Lounge of the Human Rights Foundation stated: “the decentralized nature of Bitcoin provides a financial system less susceptible to centralized failures or manipulations. In Africa, we have 46 currencies, one of the big problems is settlement.The last hope of importers and exporters in Nigeria and Sub-Saharan Africa in general is Bitcoin and USDt.”

The implementation of the ECO currency in West Africa is unnecessary if Bitcoin is fully adopted. Bitcoin's peer-to-peer networks and exchange rails offer superior efficiency and utility compared to the proposed ECO currency. By leveraging Bitcoin's strengths, West African countries can bypass the need for a new regional currency and create a robust, inclusive financial system. This adoption would address regulatory challenges, enhance technological infrastructure, and improve financial literacy, ensuring a smooth transition to a modernized financial ecosystem. The potential to reduce remittance costs, enhance financial inclusion, and facilitate cross-border transactions makes it a powerful tool for economic development in Africa. The future of Africa’s financial system lies in embracing innovative solutions that address its unique challenges. By leveraging the strengths of Bitcoin, Africa will create a reliable, inclusive, and forward-thinking financial ecosystem that supports sustainable economic growth and development.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

No comments:

Post a Comment